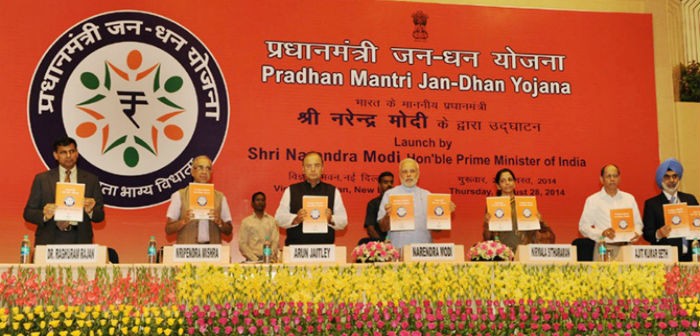

In his Independence Day speech, Indian Prime Minister Narendra Modi said 75 million families (almost 400 million people) lacking access to banking services is akin to untouchability that was prevalent against the so-called lower castes till a few decades ago.

The Pradhan Mantri Jan Dhan scheme, which he launched last Thursday, will address this issue by opening 150 million bank accounts (two per family) into which the government will transfer benefits such as subsidies, pensions, etc.

He’s right. Banks, even those in the public sector, which are supposed to, in theory at least, give equal weightage to their social responsibilities, usually chase well to do customers, giving a wide berth to the poor who cannot maintain stiff minimum balance requirements and don’t buy financial and other products marketed by the bank.

This leads to what the Prime Minister called “financial untouchability”, which experts have said is as debilitating as the still entrenched caste bias in some sections of Indian society. This exclusion from the banking mainstream drives them into the arms of frauds and tricksters as is evident from the Saradha scam in West Bengal, in which the promoters of the thinly disguised Ponzi scheme skimmed more than $3 billion from millions of poor small investors by promising absurdly high returns. In another recent fraud, a Delhi-based realtor duped 5.7 million investors of more than $8 billion via another Ponzi scheme.

Indian society now simultaneously straddles many eras. More than two decades after the launch of economic reforms that threw open the Indian economy to global competition has enabled about 350 million people the opportunities to fulfill their potential and live out their dreams. The balance 800-850 million have not received the benefits of economic liberalization. But the all pervasive penetration of TV and mobile phones – even in remote rural areas – has increased aspiration levels across all sections of society.

This aspiration coupled with lack of access to the financial mainstream and lack of awareness that drives many people to subscribe to fraudulent schemes.

Then, subsidy schemes aimed at the poor are skimmed off by middlemen and petty bureaucrats leaving only a fraction of the allocated amount for the beneficiaries. Former Prime Minister Rajiv Gandhi had said that 85 paise out of every Re 1 that the government spends on subsidizing goods and services used by the poor is either stolen or used up on administrative expenses.

The statistics are stark – and disturbing. In India, about 40 per cent of adults do not have any bank account or access to any banking services. This forces them to seek loans from local moneylenders who charge usurious rates (between 2 per cent and 10 per cent per month), often resulting in a debt bondage for life.

The Jan Dhan scheme will address this issue by offering a Rs 5,000 overdraft facility with every account and a Rs 1 lakh insurance cover. When Indira Gandhi nationalized banks in 1970 and again in 1980, India’s savings rate rose from 13 per cent to 23 per cent and set the stage for the higher rates of growth that followed. Bringing an additional 400 million people under the banking net is expected to give India’s savings rate, currently at about 30 per cent, higher and feed the investment cycle that is showing signs of opening up.

So, Modi’s scheme can kill several birds with one stone. By bringing India’s vast unbanked masses into the financial mainstream, it can encourage financial inclusion. By encouraging savings through formal banking channels it can, potentially, channel India’s massive (at the aggregate level) informal savings economy into formal banking channels and funnel these funds towards development activities.

Some concerns remain. The first is the possibility of the Rs 5,000 overdraft ($12 billion at the aggregate level) turning into non-performing assets. Then, there’s the issue of creating a humungous technological backend for smooth functioning of the scheme.

But these are early days yet. The government has begun well. And Narendra Modi and his team deserve a pat on their backs for this initiative. The rest will depend on implementation.

The above article was first published on India Inc www.indiaincorporated.com

Manoj Ladwa is the founder of India Inc and chief executive of MLS Chase Group @manojladwa